Free Equity Brokerage Calculator – Firstock

Equity Brokerage Calculator – Firstock

If you're searching for an accurate, fast, and reliable equity brokerage calculator, you're in the right place. The Firstock Brokerage Calculator is designed for traders who want to know exact trading costs before placing an order—because in trading, even a tiny difference in charges can impact your profits significantly.

This guide is covering every related concept around brokerage charges, calculations, and Firstock’s cost model. Whether you’re a beginner or an active trader, this article gives you a complete, organized breakdown of everything you need to know.

Let’s begin with the core pillar: understanding brokerage calculation.

What Is an Equity Brokerage Calculator ?

An equity brokerage calculator is an online tool that instantly computes:

- Brokerage

- STT

- GST

- Exchange charges

- SEBI charges

- Stamp duty

- Total tax and charges

- Net profit or loss

Instead of doing math manually, you get a real-time breakdown in seconds. The Firstock brokerage calculator is built exactly for this purpose.

Why Brokerage Charges Matter in Stock Trading

Many traders look only at buy and sell price, but the real profit comes after deducting all charges. Even ₹10–₹20 difference per trade can add up over months. Transparency is essential—and a brokerage calculator provides that clarity.

How Brokerage Is Calculated in Equity Trading

If you're wondering how brokerage is calculated, here's the simple truth:

Brokerage = Broker’s rate × Transaction value But other costs apply too:

- STT

- GST

- Exchange fees

- Stamp duty

- SEBI charges

This is why traders rely on a brokerage calculator instead of manual calculation.

Breakdown of All Charges Included in the Equity Calculator

A quality brokerage calculator covers all cost layers, such as:

- Brokerage fee

- Securities Transaction Tax (STT)

- SEBI turnover charges

- Exchange transaction charges

- GST on brokerage + exchange fees

- Stamp duty as per state law

Each component affects your final P&L.

What Makes the Firstock Brokerage Calculator Different?

The Firstock calculator stands out because it is:

- Simple to use

- Fast & accurate

- Designed with regulatory accuracy

- Suitable for both intraday & delivery

- Completely transparent

It shows true trading cost without hidden details.

Who Should Use an Equity Brokerage Calculator?

This tool is ideal for:

- Beginner investors

- Intraday traders

- Swing traders

- Long-term equity investors

- Anyone comparing brokerage charges

If you're here searching for brokerage calculators, this guide answers every related query

How to Use the Firstock Equity Brokerage Calculator

Just enter:

- Buy price

- Sell price

- Quantity

- Order type (intraday or delivery)

Click "Calculate" and get a complete cost sheet instantly.

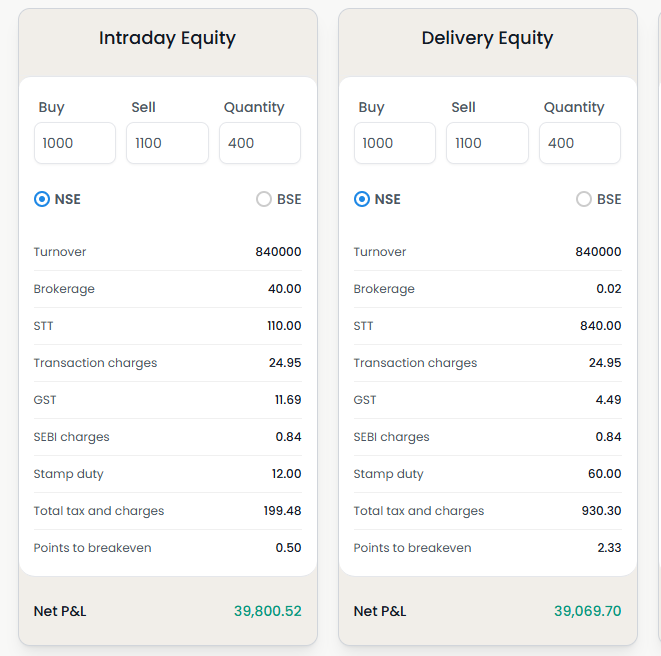

Real Example of Brokerage Calculation Using Firstock

Example:

- Buy: ₹500

- Sell: ₹520

- Quantity: 100

The calculator shows:

- Brokerage

- STT

- Exchange charges

- GST

- Stamp duty

- Final profit

This ensures you know exactly what you will earn.

Equity Delivery vs Intraday – Charge Comparison

Equity Delivery: Holding beyond one day. Charges differ from intraday.

Equity Intraday: Buy and sell same day. Lower brokerage & different tax structure.

The Firstock calculator separates both clearly.

Brokerage Charges Comparison – What Traders Really Need to Check

Here are the real factors to evaluate:

- Brokerage per order

- Exchange fees

- STT

- GST

- Hidden charges

- Stamp duty

- Intraday vs delivery cost differences

A brokerage calculator solves all these comparisons automatically.

Why Adding a Calculator Before Trading Improves Profitability

It helps you:

- Avoid unexpected deductions

- Optimize entry & exit levels

- Know your break-even level

- Avoid trades with low profit potential

- Trade smarter, not harder

Every trader benefits from using it.

Common Mistakes Traders Make While Calculating Brokerage

Most traders:

- Ignore taxes

- Forget exchange charges

- Assume zero-brokerage = zero cost

- Don’t account for stamp duty

- Skip proper comparison

Using the Firstock equity brokerage calculator avoids all these mistakes.

How the Firstock Calculator Helps You Save Money

It saves money by:

- Showing true costs upfront

- Helping you avoid high-cost trades

- Identifying unnecessary charges

- Optimizing your trade selection

Information = Profit.

Why Firstock’s Brokerage Calculator Builds Trust & Accuracy

Firstock ensures:

- Accurate regulatory calculations

- No hidden markup

- User-friendly interface

- Clear distinctions between segments

- 100% transparency

Summary: Why Every Trader Should Use a Brokerage Calculator

A brokerage calculator is not optional—it's a core trading tool. Whether you're placing 1 trade or 100 trades, knowing your cost helps you protect profits.

The Firstock equity brokerage calculator gives you:

- Instant clarity

- Accurate cost calculation

- Better decision-making

- Higher profitability

Before you place your next buy or sell order, calculate your charges. It’s the simplest way to avoid financial surprises.

Frequently Asked Questions

1. What is a brokerage calculator used for?

It helps traders calculate brokerage, taxes, and total charges before placing equity trades.

2. Does the Firstock equity brokerage calculator include all taxes?

Yes, it includes brokerage, STT, GST, SEBI charges, exchange fees, and stamp duty.

3. How do I calculate brokerage for intraday trading?

Enter buy price, sell price, quantity, and choose “intraday” in the calculator. The tool handles everything automatically.

4. What is brokerage charges comparison?

It means comparing total trading costs—brokerage, taxes, and fees—to choose the most cost-effective trading platform.

5. Why is an equity brokerage calculator important?

It reveals the actual profit or loss after all charges, helping traders make better decisions.