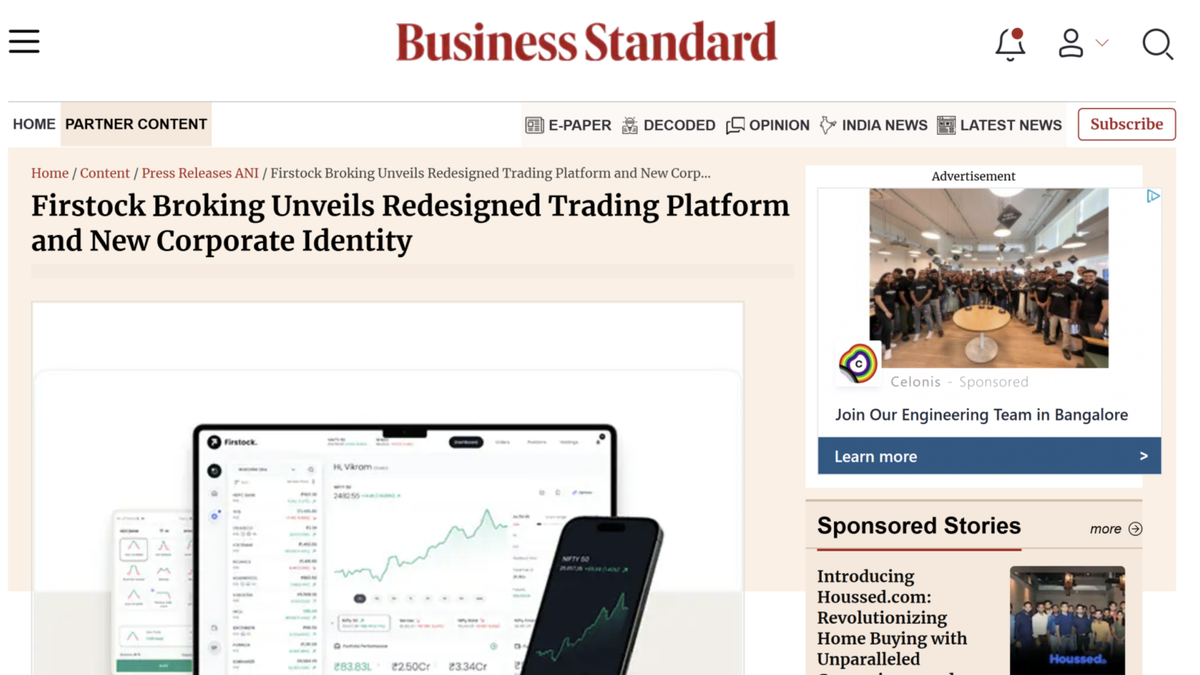

Firstock Broking Unveils Redesigned Trading Platform and New Corporate Identity

Firstock Broking Pvt. Ltd., previously known as NCO Securities and Share Broking Pvt. Ltd., proudly announced today the launch of its fully redesigned trading and investment platform, alongside its refreshed corporate identity. This strategic rebranding marks the culmination of an intensive year-long transformation aimed at enhancing user experience, simplifying trading processes, and integrating cutting-edge technology.

The revamped Firstock platform underscores the company's commitment to offering retail and professional investors a seamless, transparent, and technologically advanced investment experience.

"At Firstock, we believe powerful solutions lie in simplicity. Our redesigned platform embodies our mission to eliminate complexity from investing, positioning us as true partners in our customers' financial journeys," said Vikram Ayanur Venkatesh, CEO of Firstock Broking Pvt. Ltd.

Enhanced User Experience

The newly launched web and mobile platforms feature a user-friendly interface, designed meticulously to provide intuitive navigation and streamlined trading processes. Investors can effortlessly explore curated investment options across various asset classes, including stocks, ETFs, and derivatives.

Key highlights of the new Firstock platform include:

Simplified Interface: User-friendly navigation designed for both beginners and experienced investors.

Strategy Builder: Comprehensive tool including Payoff Charts for planning, building, and executing strategies, premium selection options such as Strangle and Straddle, and one-click execution for complex strategies.

Basket Order: Convenient creation and detailed analysis of order baskets before execution.

Advanced Analysis: Robust tracking and in-depth analysis of open F & O positions, providing a holistic 360-degree overview.

Tailored Equity Investments: Curated long-term investment options including ETFs, Gold Bonds, and Government Securities, with tools for fundamental analysis, stock screening, and detailed portfolio evaluations.

Enhanced F & O Trading: Bulk quantity trading with market protection, comprehensive strategy-building capabilities, detailed position monitoring, and analysis.

Developer API: Detailed documentation for seamless integration, providing programmatic access to trading capabilities and market data, completely free for investors and traders.

Transparent and Competitive Pricing

Firstock has introduced a transparent and highly competitive pricing structure, ensuring cost-effective investing:

₹0 Account Opening Charges

₹0 Annual Maintenance Charges (AMC)

₹0 Brokerage on Equity Delivery Trades

₹0 Charges for Pledging Securities

₹0 Payment Gateway Fees

₹0 Charges on Direct Mutual Fund Investments

₹20 per order on F & O and Intraday Trades

Note: Brokerage will not exceed the SEBI-prescribed limit.

Commitment to Innovation

Firstock's transformation emphasizes continuous innovation tailored to evolving market demands. By integrating advanced analytical tools, robust security features, and user-centric interfaces, Firstock ensures investors enjoy fast, reliable, and secure trading experiences.

"We're dedicated to simplifying trading and investment processes, equipping our users with powerful and user-friendly tools to enhance their investment decisions," Vikram added.

Firstock started in June 2021 as a fully bootstrapped company and reached a major milestone by achieving self-clearing status through ICCL membership in November 2024, significantly enhancing its operational independence and market presence.

The platform is now live and accessible to investors across India via the Firstock web app and dedicated mobile applications on Android and iOS.

Disclaimer: The securities are quoted as an example and not as a recommendation. Investments in the securities market are subject to market risks. Read all the related documents carefully before investing.

About Firstock Broking Pvt. Ltd.

Firstock Broking Pvt. Ltd., formerly known as NCO Securities and Share Broking Pvt. Ltd., is a SEBI-registered brokerage firm (Registration No.: INZ000260334), with NSE Membership Code: 90047 and BSE Membership Code: 6101. The company's registered office is located at No. 350, 1st Floor, 36th A Cross, 7th Main Road, 5th Block, Jayanagar, Bangalore - 560041, Karnataka, India. Focused on innovation, transparency, and simplicity, Firstock offers a comprehensive trading and investment platform designed to serve the diverse needs of investors and traders across India.

Source: Business Standard