Indian Stock Market Today: Nifty Closing, Post Stock Market Review 19-2-2026

Post Market Pulse: The indian stock market today 📊

Date: February 19, 2026

The Nifty 50 faced a brutal sell-off today, snapping its three-day winning streak as the index plunged over 1.4% to erase all recent gains. The market sentiment turned sour following reports of renewed US-Iran tensions and a lack of fresh domestic triggers. What began as a mild opening quickly deteriorated into a consistent downward drift, with the index sliding below the crucial 25,500 psychological mark. Heavyweights in the Auto, IT, and Realty sectors led the decline, reflecting a cautious "risk-off" mood among investors as geopolitical uncertainties outweighed recent structural recovery hopes.

Index Performance Snapshot

Nifty 50

25,454.35 | -365 (-1.41%)

Intraday Analysis: The index witnessed a dismal session, starting under pressure and hitting a series of lower lows. After failing to sustain near the 25,800 level early in the day, the index witnessed a steady slide, reaching an intraday low of 25,388.75. A weak closing at the lowest point of the day indicates intense bearish momentum heading into the next session.

Top Gainers (Nifty 50)

Top Losers (Nifty 50)

F&O Corner

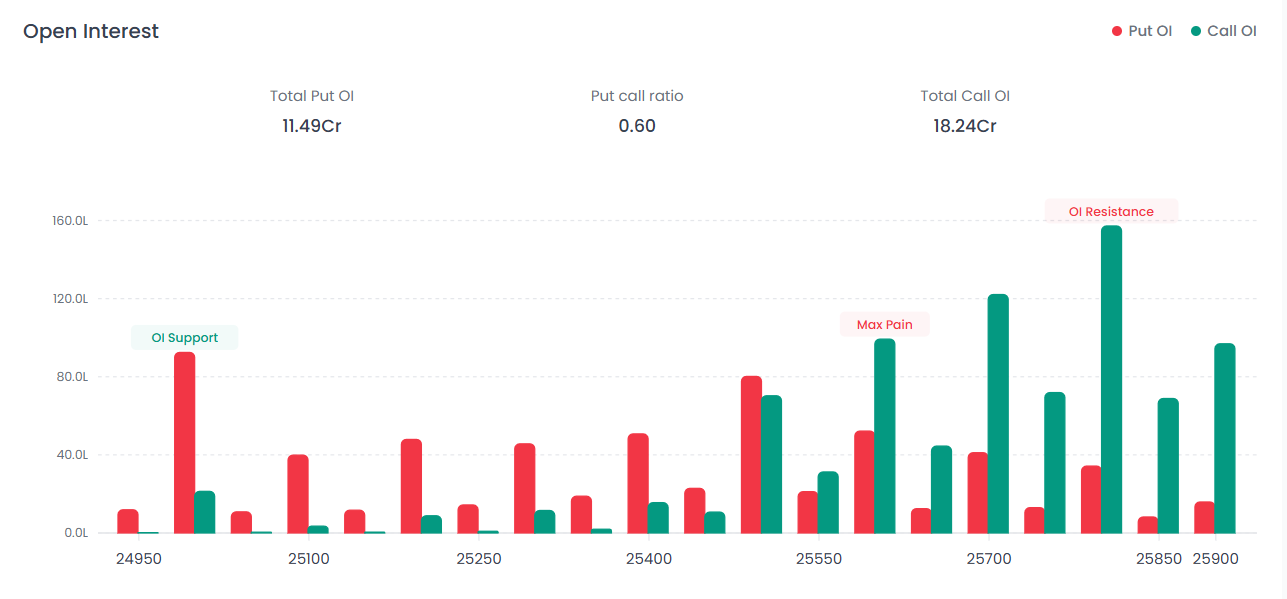

OI Analysis

Near Resistance: 25,800 The 25,800 strike has emerged as a significant hurdle for the bulls, with massive Call OI concentration visible at the 25,800 and 25,700 strikes. Total Call OI for the session stands at 18.24 Cr.

Near Support: 25,000 The 25,000 strike (highlighted as OI Support) remains the primary base, though immediate cushions are thinning. Total Put OI for the session stands at 11.49 Cr.

PCR Analysis: 0.60 The Put-Call Ratio (PCR) has dropped sharply to 0.60, reflecting a highly bearish sentiment. The fact that Call OI significantly outweighs Put OI suggests aggressive call writing, indicating that traders expect further resistance on any recovery attempts.

Max Pain

The Max Pain Strike is currently pegged at 25,600.00. With the market closing at 25,404, the index is positioned well below the Max Pain level, suggesting that option sellers (particularly Put writers) faced significant pressure during today's expiry/session.

India VIX

Current Level: 13.46 | +1.23 (+10.12%)

Interpretation: The "Fear Gauge" spiked significantly today, rising over 10%. This sharp expansion in volatility suggests that market anxiety is returning, pointing toward a more erratic and unstable environment in the short term.

Major Market Drivers

Broad-based Sell-off: Heavy selling in Auto (M&M) and Cement (UltraTech) acted as the primary drags on the index. The lack of buying interest across major sectors suggests a temporary risk-off sentiment among investors.

Aviation & Retail Under Pressure: Interglobe Aviation and Trent led the losers' list, indicating profit booking in stocks that had previously seen a strong run-up.

Energy Outperformance: ONGC stood out as a lone warrior, gaining 3.80% amidst the carnage, likely supported by movements in crude prices or sector-specific tailwinds, providing the only major cushion to the Nifty.

Indian Stock Market Today – Technical Summary

Final Outlook – Indian Stock Market Today

The Indian stock market today reflects a sharp shift back to risk-off sentiment. The breakdown below the 25,500 psychological mark, combined with a falling PCR and a sharp spike in India VIX, indicates growing caution in the derivatives space.

For the upcoming session, 25,000 remains the critical structural support, while 25,800 acts as the key recovery barrier. Unless the index reclaims 25,700–25,800 decisively, recovery attempts may face selling pressure.

FAQs

1. How did the Indian stock market today perform? The Nifty 50 fell 1.41% to close at 25,454.35, snapping a three-day winning streak.

2. Why did the Indian stock market today fall sharply? Renewed US-Iran geopolitical tensions, lack of domestic triggers, and heavy selling in Auto and IT sectors triggered the decline.

3. What does a PCR of 0.60 indicate? A PCR of 0.60 signals strong bearish sentiment, with call writers dominating the derivatives market.

4. Is volatility increasing in the Indian stock market today? Yes. India VIX jumped over 10%, indicating rising fear and wider expected price swings.

5. What level is important for tomorrow? 25,000 is the key support, while 25,800 is the major resistance level.

Disclaimer: This report is for informational purposes only and does not constitute financial advice. Please consult your financial advisor before making any investment decisions.

Happy Trading!

The Firstock Team