Is Online Trading Safe in 2026? | Firstock Trading App

Is Online Trading Safe? (The Truth No One Tells You)

You want to start online trading, but you have a nagging fear:

- Will my money vanish?

- Is the app rigged?

- What if the broker runs away?

These are not silly doubts. They are intelligent questions. In fact, anyone entering the stock market without asking these questions is taking a bigger risk than necessary.

Let’s address it directly.

✅ The Short Answer

Yes, online trading is safe.

⚠️ The Real Answer

Online trading is safe only if you choose a SEBI registered broker that prioritizes security, compliance, and infrastructure over flashy advertisements and aggressive marketing campaigns.

If you’re searching:

- Trading is safe or not?

- Are online trading platforms in India secure?

- Is an online trading platform trustworthy?

This article will give you a complete, transparent, and realistic answer — without sugarcoating anything.

Trading Is Safe or Not ?

Online trading is safe in India when you use a SEBI-registered broker, your shares are stored in a Demat account with CDSL or NSDL, and the platform follows strict security and compliance standards.

It becomes unsafe only when:

- You choose an unregulated broker

- The platform lacks infrastructure stability

- Hidden fees drain your capital

- Data privacy is compromised

Now let’s go deeper.

How Online Trading Works in India (And Why It’s Regulated)

India’s stock market ecosystem is one of the most strictly monitored systems in the world.

The entire structure is supervised by:

🏛️ Securities and Exchange Board of India (SEBI)

- Stock exchanges

- Brokers

- Depositories

- Mutual funds

- Market intermediaries

No broker can legally operate without SEBI registration.

Where Are Your Shares Actually Stored?

Your shares are NOT stored with your broker.

They are stored in a Demat account maintained by:

- Central Depository Services Limited (CDSL)

- National Securities Depository Limited (nsdl india depository")

These are government-regulated depositories.

Even if your broker shuts down:

- Your shares remain in your Demat account

- You can transfer them to another broker

- Ownership does not disappear

This is the biggest myth people don’t understand.

What “Safe” Really Means in Online Trading

When people ask, “Is online trading safe?” they usually mean:

“Will someone steal my money?”

But safety in online trading has three layers.

1️⃣ System Safety (Execution Safety)

The biggest risk in online trading is not market volatility.

It’s your app freezing during high-volatility events.

Think about:

- Budget announcements

- Election results

- RBI policy decisions

- Global market crashes

If your app crashes while you’re trying to exit a position, you lose money.

System safety means:

- High-availability servers

- Fast order routing

- Low latency

- No freezing during peak hours

This is where many online trading platforms in India struggle.

They invest heavily in marketing.But under-invest in backend infrastructure.

2️⃣ Capital Safety (Hidden Charges Risk)

Safety is also about protecting your capital from silent erosion.

Some brokers advertise:

₹0 brokerage!

But then charge:

- Account Opening Fees

- Annual Maintenance Charges (AMC)

- Platform Subscription Fees

- Call & Trade Charges

- Margin Penalties

Over time, these small deductions compound.

A safe online trading platform should offer:

- Transparent pricing

- No surprise deductions

- Clear cost structure

3️⃣ Data Safety (The Hidden Risk No One Talks About)

Your trading account contains:

- PAN

- Aadhaar

- Bank details

- Investment portfolio

- Trading behavior

If that data is misused or sold, you become vulnerable.

A secure online trading platform must provide:

- 256-bit encryption

- Two-factor authentication

- Secure login systems

- Strict SEBI compliance

Not all platforms treat your financial data with equal seriousness.

Why Broker Choice Decides If Trading Is Safe or Not

The Indian stock market system is safe.

But your broker determines your personal experience.

Here’s the uncomfortable truth:

Some brokers:

- Prioritize marketing over execution

- Focus on gamification

- Encourage overtrading

- Hide charges in fine print

You don’t need entertainment.You need reliability.

This is where Firstock positions itself differently.

Why Firstock Is Built for Serious Traders

Firstock - stock trading app is not designed to gamify the market.

It is built on the philosophy of:

Trade What’s Next.

Instead of flashy popups and dopamine-driven notifications, it focuses on:

- Speed

- Transparency

- Execution stability

- Trader-centric design

Let’s examine how this impacts safety.

1️⃣ System Safety: Infrastructure That Doesn’t Freeze

Many large brokers crash during:

- Budget Day

- Major IPO listings

- Election results

- Global market volatility

Execution delay can cost thousands.

Firstock - option trading app is built with:

- Ultra-light backend architecture

- Optimized execution engine

- Stable order routing

When you press “Sell,” it sells.Immediately.

In trading, milliseconds matter.

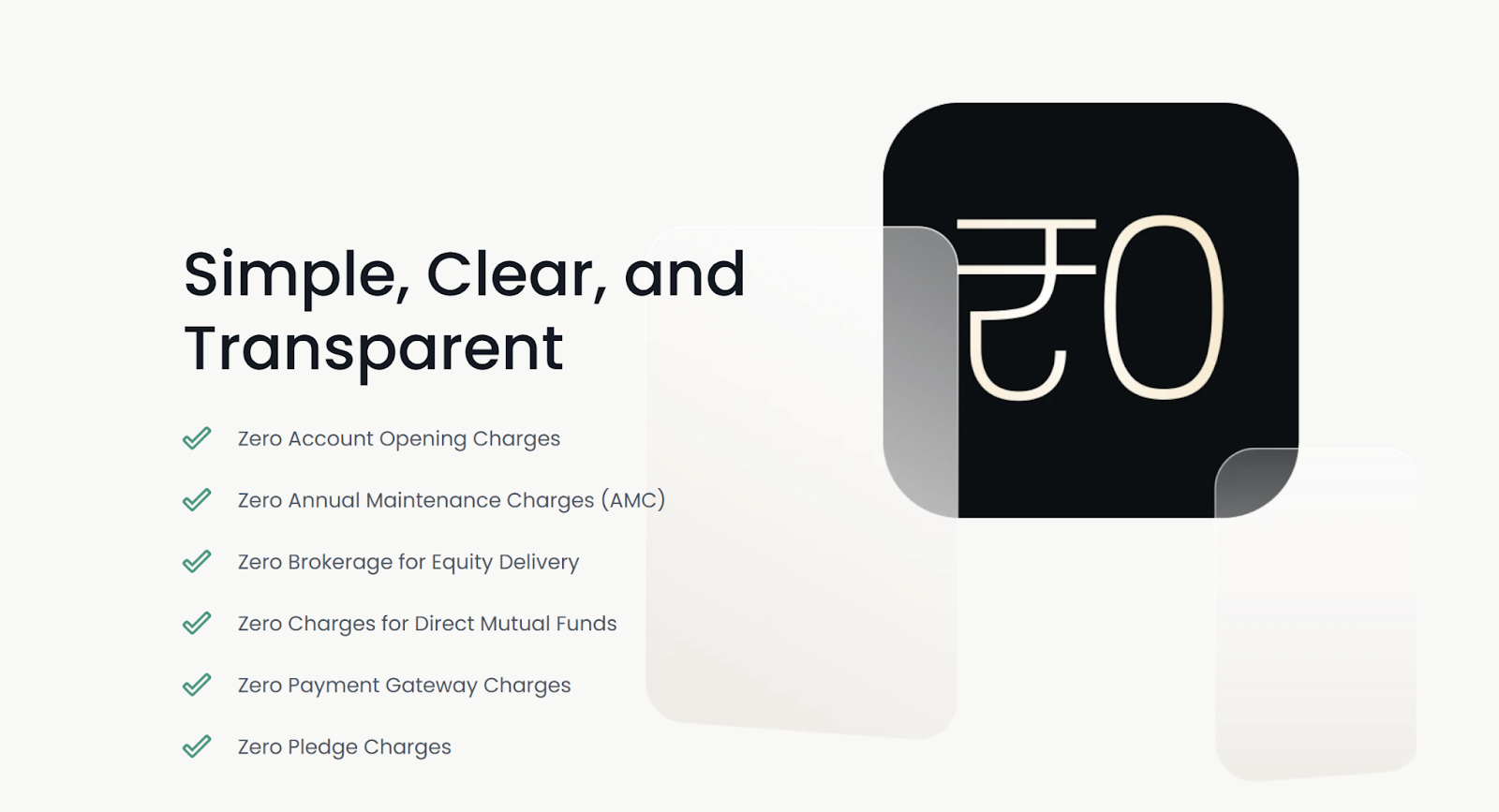

2️⃣ Zero Hidden Charges = Capital Safety

Here’s a practical comparison:

Lifetime Zero AMC means:

- No yearly maintenance deduction

- No slow capital erosion

- No surprise debits

Safety includes protecting profits from unnecessary fees.

3️⃣ SEBI Registered & Fully Compliant

Firstock operates under SEBI regulations.

Client funds are:

- Kept in segregated accounts

- Audited

- Exchange-monitored

Your shares remain safely stored with CDSL/NSDL.

Even in worst-case scenarios, ownership remains protected.

Features That Actually Help You Trade Smarter

Many online trading platforms in India are designed for casual investors.

Firstock is built for active traders.

🔹 Custom Drag & Drop Interface

Design your own layout:

- Charts left

- Order book right

- Watchlist full screen

You build your own trading cockpit.

🔹 Updated One-Click Mode

In scalping:

One second = profit or loss.

One-Click Mode bypasses confirmation popups.Instant execution.

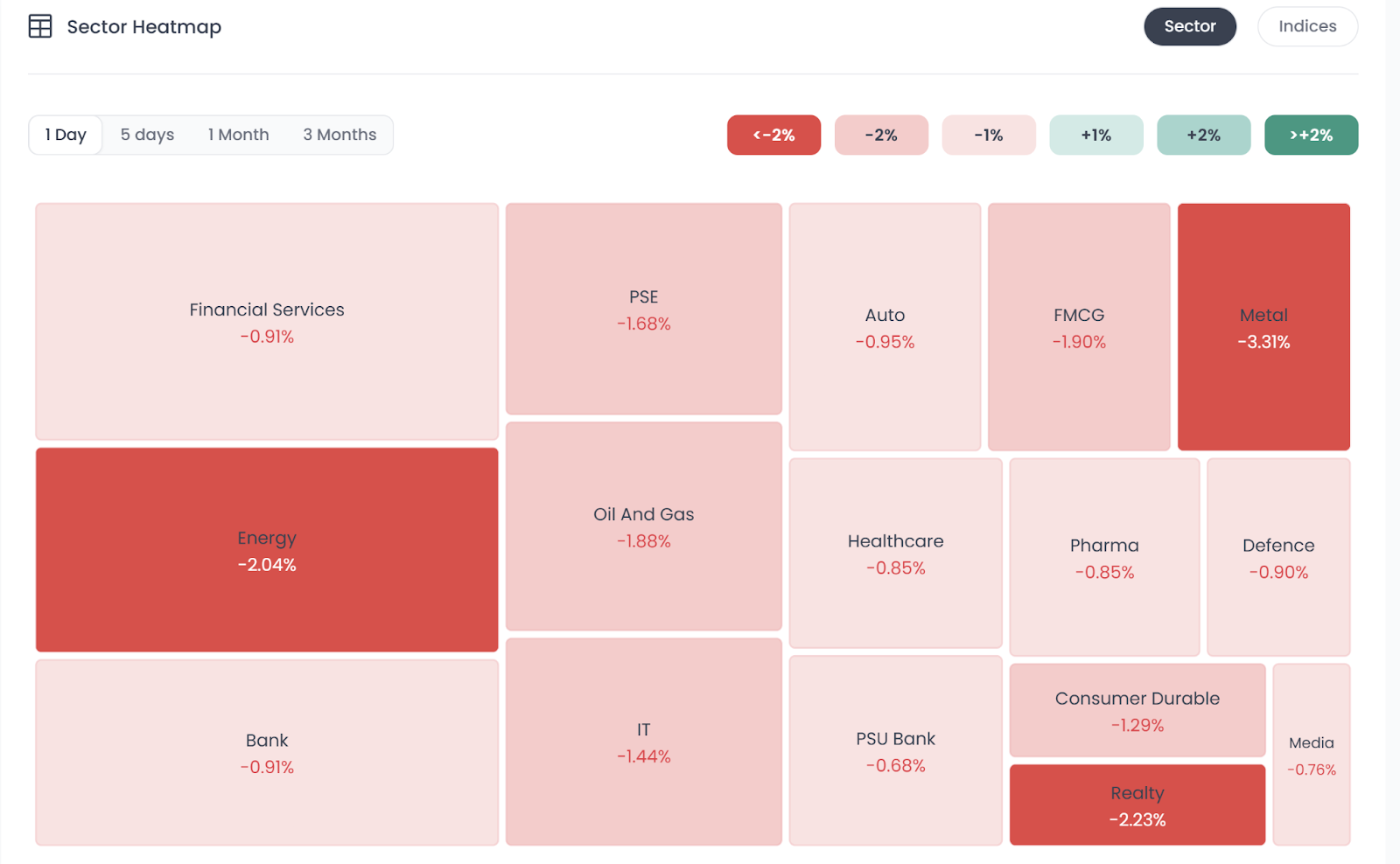

🔹 Sector Heatmap

Visualize:

- Auto

- IT

- Banking

- Pharma

- FMCG

Identify sector rotation early.

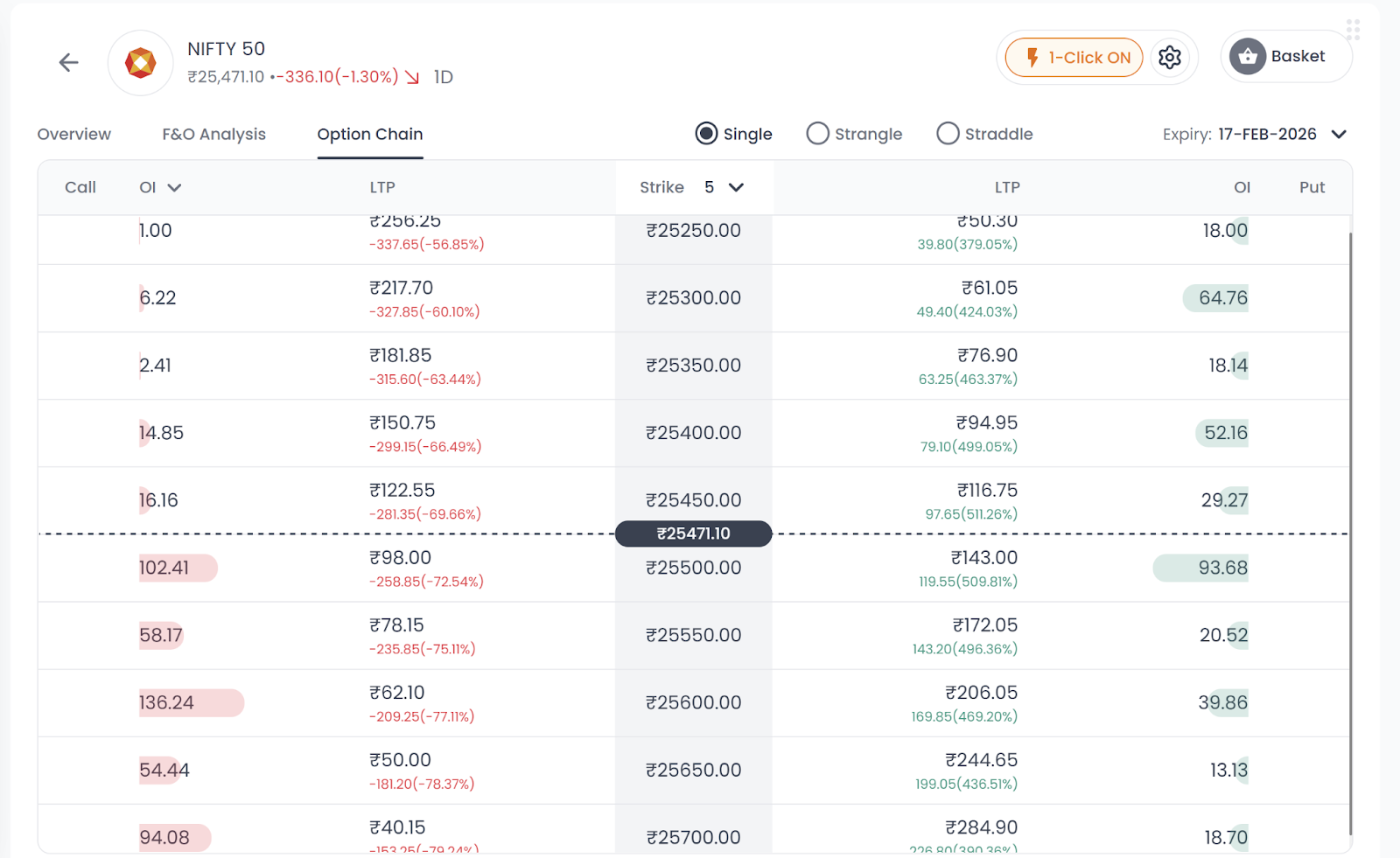

🔹 OI Trend (Institutional Insight)

Price tells you the past.Open Interest shows positioning.

Track:

- Long buildup

- Short buildup

- Short covering

- Long unwinding

This adds strategic clarity.

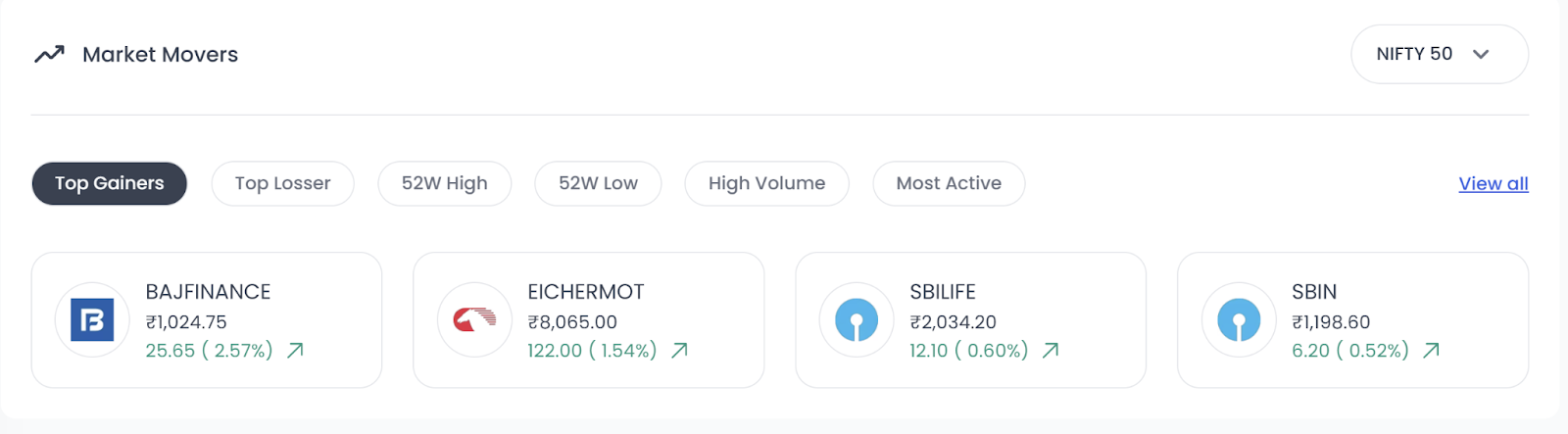

🔹 Market Movers Dashboard

Instantly see:

- Top gainers

- Top losers

- Volume shockers

All in one screen.

🔹 Visual Logo Clarity

Quick brand recognition reduces trading errors.Spot Reliance or Tata instantly without scanning ticker codes.

Small feature.Big impact.

Firstock vs “The Giants” – The Unspoken Truth

Many traders assume:

Big brand = safest broker.

But consider this:

Big brands have:

- TV ads

- Celebrity endorsements

- Massive marketing budgets

Who pays for that?

You do.Through indirect costs.

A lean broker focused on infrastructure often delivers better trading performance.

Who Should Use Firstock?

Firstock is ideal for:

- Intraday traders

- Scalpers

- Options traders

- Swing traders

- Algo traders

Especially those who care about:

- Execution speed

- Zero AMC

- Transparent charges

- Stability during volatility

Who Should Avoid Online Trading?

Online trading is NOT for:

- People looking for guaranteed returns

- Emotional traders

- People without risk management

- Those unwilling to learn

Trading is safe structurally.But markets carry risk.

Final Verdict: Is Online Trading Safe?

Let’s answer clearly.

❌ Online trading is unsafe if:

- You use an unregulated broker

- The platform crashes frequently

- Charges are hidden

- You don’t manage risk

✅ Online trading is safe if:

- The broker is SEBI-registered

- Shares are stored with CDSL/NSDL

- Infrastructure is stable

- Charges are transparent

- Data security is strong

When these conditions are met, online trading becomes:

- Efficient

- Regulated

- Secure

- Scalable

And that is the foundation Firstock - discount broker in India emphasizes.

Conclusion: Safety Is a Choice

Online trading is not gambling.It is a regulated financial activity.

But safety depends on:

- Regulation

- Infrastructure

- Transparency

- Broker integrity

Choose wisely.

Because in trading:

Speed protects profits.Transparency protects capital.Regulation protects ownership.

If you are evaluating online trading platforms in India, don’t just compare brokerage numbers.

Compare:

- Execution reliability

- Backend strength

- Compliance standards

- Hidden cost structure

That’s how you decide whether trading is safe or not.

FAQs

1. Is online trading safe in India?

Yes. Online trading in India is safe when conducted through a SEBI-registered broker and when shares are stored in a Demat account with CDSL or NSDL.

2. Trading is safe or not for beginners?

Trading is safe structurally, but beginners must:

- Learn risk management

- Avoid leverage misuse

- Choose a regulated online trading platform

3. What happens if a broker shuts down?

Your shares remain safe in your Demat account with CDSL/NSDL. You can transfer them to another broker.

4. Are online trading platforms in India regulated?

Yes. All legal brokers must be registered with SEBI and comply with exchange and depository regulations.

5. Can online trading apps manipulate prices?

No. Brokers cannot manipulate exchange prices. Orders are routed directly to stock exchanges.

6. Is Firstock safe for long-term investing?

Yes. It is SEBI-registered, compliant, and your shares are stored with regulated depositories.

7. Is the Firstock API safe for algo trading?

Yes. It uses secure encryption. Traders can implement order limits to prevent strategy errors.

8. How fast are withdrawals?

Funds are processed as per exchange settlement cycles (T+1). Withdrawal requests are processed within 24 hours after funds reflect.

9. Can I trade on multiple devices?

Yes. Firstock is cloud-synced across web and mobile platforms.

10. Is there any AMC in Firstock?

No. Firstock offers Lifetime Zero AMC.

Disclaimer: Investments in securities markets are subject to market risks. Read all related documents carefully before investing.