Market Pulse: The Week in Review 📊

This week, the markets demonstrated resilience with a cautious undertone, as benchmark indices largely moved sideways amid profit booking at higher levels. While frontline indices paused, broader markets showed selective strength, indicating consolidation rather than a trend reversal.

Index Performance Snapshot

A quick review of the major indices shows the market momentum for the week.

1. Nifty 50 25,966.40 | -80.55 (-0.31%)

Nifty 50 ended slightly lower, indicating profit booking near record highs. The broader trend remains intact, with the index moving into a short-term consolidation phase in the absence of fresh triggers.

2. Nifty Midcap 100 60,310.15 | +26.85 (+0.04%)

The midcap index closed marginally higher, reflecting selective buying. Holding above key levels suggests underlying strength, even as the index consolidates after its recent rally.

3. Nifty Smallcap 100 17,390.35 | +0.40 (+0.00%)

Smallcaps ended flat, pointing to pause and consolidation. Selling pressure remains limited, but holding the support for now.

Top Gainers (Nifty 500)

These stocks led the charge, delivering the highest returns this week.

Top Losers (Nifty 500)

The following stocks faced selling pressure and registered the week's biggest declines.

F&O Corner

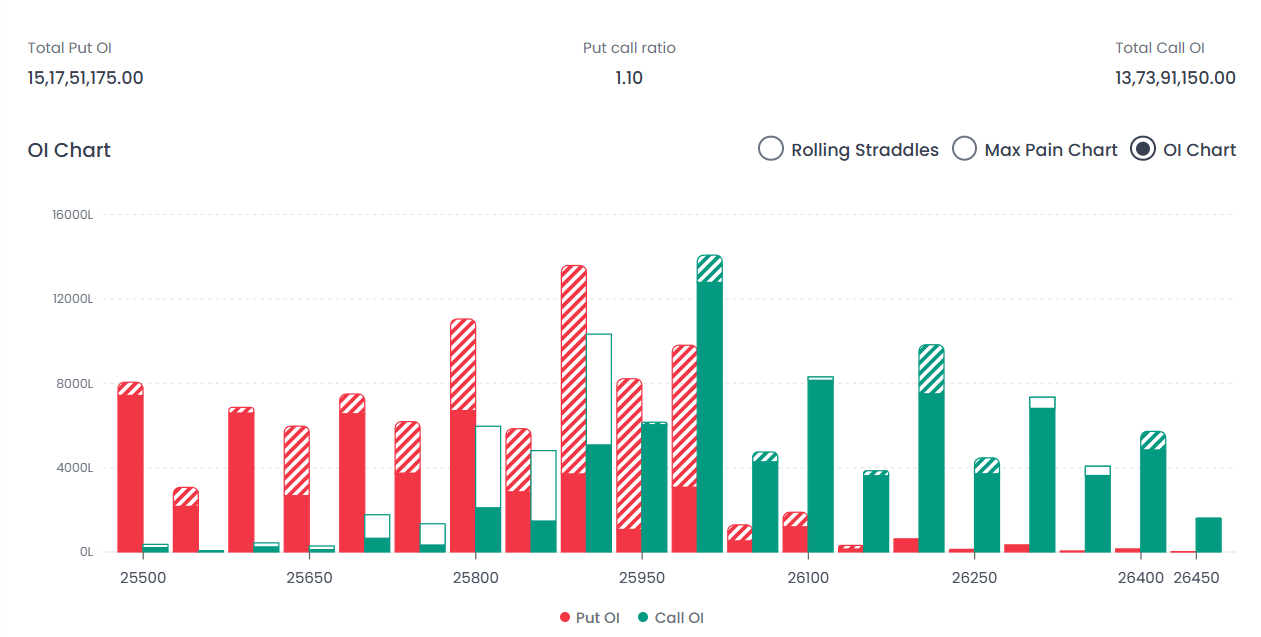

OI Analysis

Understanding Open Interest (OI) helps gauge market sentiment and potential price movements for the next expiry.

Max Pain Point: 26,000 (The psychological hurdle where massive Call writing caps the upside) Near Resistance for the Week: 26,000 (Highest Call OI observed here, creating a strong "Ceiling" for the market) Near Support for the Week: 25,900 (Significant Put accumulation indicating strong demand and a "Floor" for the price)

Put Call Ratio (PCR) Present Ratio: 1.10 | Current Scenario: MILDLY BULLISH (A PCR > 1 indicates more Put writing than Call writing, suggesting the market sentiment is to buy on dips rather than sell on rises.)

Interpretation: The market is currently squeezed in a tight 100-point range between the 25,900 support and 26,000 resistance. A decisive breakout above 26,000 is needed for a rally, while a breakdown below 25,900 could lead to further weakness.

Volatility Index (India VIX)

The 'Fear Index' reflects the market's expectation of volatility

India VIX 9.5225 | -0.5850 (-5.79%)

- Interpretation: A declining VIX suggests cooling volatility and growing market confidence. With the index below 10, the market is currently in a "low risk" zone, which keeps option premiums low.

Major News & Upcoming Events

A summary of the major developments from the past week and a look at the events that will drive the market in the coming days.

Major News of the Past Week

- Ola Electric Stake Sale - Founder Bhavish Aggarwal sold 2.83 crore shares worth ₹90.3 crore at ₹31.9 apiece, marking his third consecutive day of selling.

- New Securities Bill - FM Nirmala Sitharaman tabled the Securities Markets Code, 2025 in the Lok Sabha to replace three existing laws with a unified regulatory framework.

- Rupee Hits Record Low - The Rupee slumped past the crucial 91 mark against the US dollar to an all-time low due to sustained FPI selling and dollar outflows.

- BoJ Hikes Rates - The Bank of Japan raised interest rates to a 30-year high, pushing 10-year bond yields above 2% and signaling further increases are likely.

- US Market Rall - US stocks are ticking higher with near-record inflows as investors anticipate lower borrowing costs and a traditional year-end rally.

Key Events for the Upcoming Week

Disclaimer: This report is for informational purposes only and does not constitute financial advice. Please consult your financial advisor before making any investment decisions.

Happy Trading!

The Firstock Team