OTM Full Form in Trading – Meaning & Example | 2026

OTM Full Form in Trading: The "Lottery Ticket" of the Stock Market

If you are new to options trading, you have probably been tempted by those cheap options costing ₹5 or ₹10. You think, "If I buy 1000 quantities, and it goes to ₹100, I will be rich!"

Welcome to the world of OTM Options.

While they offer the dream of massive returns for a small investment, they are also the graveyard of many trading accounts. Understanding OTM full form in trading and the mechanics behind it is the single most important lesson in risk management you will learn.

In this guide, we will decode what out of the money stock options are, why they are so cheap, and when is the only right time to buy them on Firstock - Trading App.

What is the OTM Full Form in Trading?

The OTM full form in trading is "Out of The Money."

It refers to an option contract that has Zero Intrinsic Value.

- The Reality: If the option expires today, it is worthless (₹0).

- The Price: Since it has no real value yet, the premium you pay is entirely "Time Value" (Hope).

The Golden Rule:

- OTM Call: Strike Price is HIGHER than the Current Market Price. (The market hasn't reached there yet).

- OTM Put: Strike Price is LOWER than the Current Market Price. (The market hasn't fallen there yet).

Understanding Out The Money with Examples

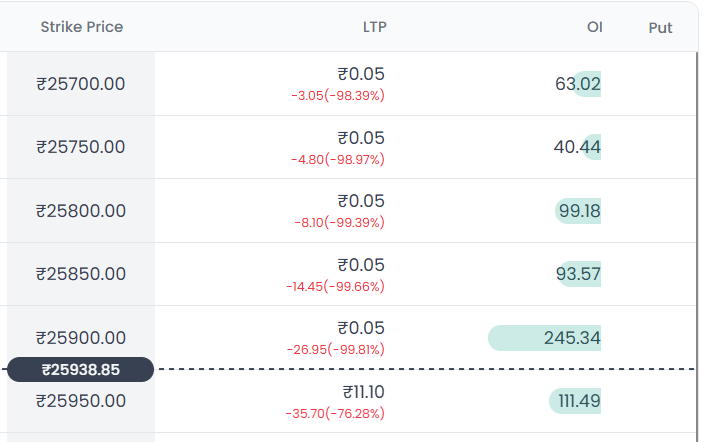

Let's assume the Nifty is trading at 25,939.

1. OTM Call Option (Bullish Bet)

You believe the market will skyrocket.

- You buy a 26,150 Call.

- Why is it OTM? Because the Nifty is at 25,939. It needs to travel ~200 points just to reach your strike.

- Status: It is "Out" of the money range.

2. OTM Put Option (Bearish Bet)

You believe the market will crash.

- You buy a 25,750 Put.

- Why is it OTM? Because the Nifty is at 25,939. It needs to fall ~150 points to reach your strike.

Why Are OTM Options So Cheap?

You see an ATM option for ₹100 and an OTM option for ₹10. Why?

It comes down to Probability.

- ATM/ITM: High probability of profit. Expensive.

- OTM: Low probability of profit. Cheap.

Think of out of the money stock options like a lottery ticket. The chance of winning is low (maybe 10%), so the ticket price is low. However, if the impossible happens (a massive market crash or rally), the ₹10 premium can become ₹100, giving you 10x returns. This "Leverage" is what attracts beginners.

The Danger Zone: Why Most Beginners Lose Money

The biggest trap in out the money trading is Theta Decay (Time Decay).

- The Problem: OTM options are made of 100% "Time Value."

- The Process: Every day that passes, a chunk of that value vanishes.

- The Result: If the market stays sideways or moves slowly, your OTM option will bleed value. Even if the market moves slightly in your favor, you might still lose money because time is working against you.

Fact: 80-90% of OTM options expire worthless. This is why Option Sellers love selling them.

When Should You Actually Buy OTM?

Is OTM always bad? No. There are specific "Hero or Zero" moments where OTM is the best strategy.

1. High Impact Events (Budget / Election) When you expect a violent move (e.g., 500+ points in a day). Buying OTM here makes sense because if the explosion happens, the Delta spikes, and you get massive ROI with limited risk.

2. Hedging (Insurance) If you hold a portfolio of ₹10 Lakhs, you can buy a deep OTM Put on Nifty for cheap. If the market crashes 10%, your portfolio bleeds, but your cheap OTM Put will explode in value, covering your losses.

How to Trade OTM on Firstock

- Analyze the Trend: Don't buy OTM in a boring, sideways market. You need momentum.

- Open Option Chain: Log in to Firstock - Option Trading App.

- Identify Strikes: Look for strikes away from the center (Spot Price).

- Calls: Look at higher strikes.

- Puts: Look at lower strikes.

- Check Volume: Ensure there are enough buyers/sellers. Don't go so far OTM that there is zero liquidity.

The "Speed" Problem: Understanding OTM Delta

Why does your OTM option barely move even when the market is going up? The answer is Delta.

Delta measures how much an option price moves for every 1-point move in the underlying stock.

The Math:

- Scenario: Nifty moves up by 50 points.

- ATM Buyer (Delta 0.5): Profits ₹25.

- OTM Buyer (Delta 0.2): Profits only ₹10.

Key Insight: When you buy out the money, you are driving a car with a weak engine. You need a massive push (market rally) just to get going. This is why "scalping" with OTMs is usually a bad idea.

The Break-Even Reality Check

Beginners think: "I bought a 24,200 Call. If Nifty crosses 24,200, I make money." Wrong.

You must account for the premium you paid.

- Strike Price: 24,200

- Premium Paid: ₹50

- True Break-Even: 24,200 + 50 = 24,250.

You only start making real profit after Nifty crosses 24,250. Until then, you are just recovering your cost. OTM options have a higher break-even point relative to the spot price compared to ITMs.

The Professional's Edge: Selling OTMs

While beginners buy OTMs hoping for a jackpot, professionals sell (write) OTMs to become the "Casino."

Why Sell OTMs?

- Win Rate: High (60-80%). You win if the market goes up, stays flat, or falls slightly.

- Theta is Your Friend: You collect the time decay. Every day the market does nothing, you make money.

The Strategy (Credit Spreads): Instead of just buying a Call, try this:

- Buy an ATM Call (to profit from the move).

- Sell an OTM Call (to reduce your cost).

- Result: This is a "Bull Call Spread." You profit if the market goes up, but the OTM sale pays for part of your ATM purchase, lowering your risk!

How Far OTM Should You Go?

Don't pick strikes randomly.

- Too Close (Near OTM): Good for trading. High liquidity, decent Delta. (e.g., 1-2 strikes away).

- Too Far (Deep OTM): The "Penny Options." (e.g., 500+ points away).

- Risk: These often have huge Bid-Ask Spreads. You might buy at ₹5.00 but find buyers only at ₹4.00 immediately after. You lose 20% instantly on entry.

- Rule: Avoid Deep OTMs unless you are hedging a massive portfolio.

Checklist: Before You Click "Buy" on an OTM

- Is there momentum? Only buy OTM if the candles are big and green/red. Do not buy in a choppy market.

- Is Expiry near? Avoid buying OTMs on Expiry Day (Thursday) after 1:00 PM unless you are gambling. They decay to zero very fast.

- Is IV low? Buy OTMs when Volatility (IV) is low. If IV spikes, your cheap option will balloon in price even if the market moves slightly.

Conclusion: Handle with Care

Knowing the OTM full form in trading is easy; knowing how to trade it takes discipline. OTMs are not for daily income; they are for specific, high-momentum shots.

The Pro Advice:

- Use ITM/ATM for regular trading.

- Use OTM only for hedging or low-cost speculation (Hero/Zero).

Frequently Asked Questions (FAQs)

1. Does OTM mean I will lose money?

Not necessarily, but the odds are against you. OTM means the option currently has no "real" value. For you to profit, the market must move fast and far in your direction before time runs out.

2. What happens if my OTM option expires out of the money?

It expires worthless. The value becomes ₹0. You lose the entire premium you paid. There is no penalty beyond that.

3. Why do sellers sell OTM options?

Because sellers (writers) profit from Time Decay. Since most OTM options expire worthless, sellers collect the premium as "free money" as long as the market doesn't make a wild move.

4. Can OTM become ITM?

Yes! If the market moves significantly, an Out of The Money option can turn into an In The Money (ITM) option. This is where the "Jackpot" profits come from.

Disclaimer: The content should not be construed as investment, trading, or personal financial advice.This blog is for educational purposes only.