Post Market Analysis: Nifty Closing, Post Stock Market Review 22-1-2026

Post Market Pulse: The Day in Review 📊

The Indian equity market staged a resilient recovery, telling a significantly different story compared to the recent sell-off. While the bears attempted to exert pressure during the mid-session dip, aggressive buying at lower levels fueled a sharp rebound, pushing the index to close firmly in the green. This strong recovery signals solid demand near key psychological levels and suggests that bulls are actively re-entering the fray to defend support zones.

Index Performance Snapshot

A quick review of the major indices shows the market momentum for the day.

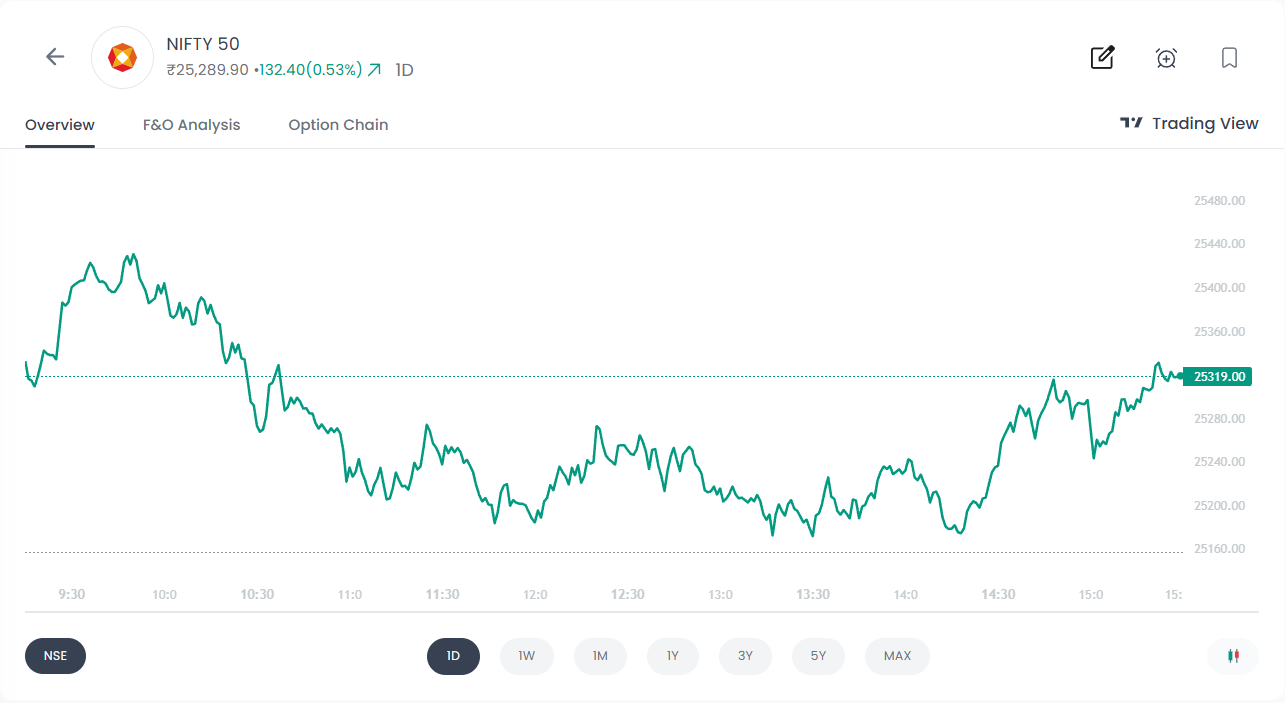

1. Nifty 50

25,289.9 | +132.40 (+0.53%)

Intraday Analysis: The market displayed resilience after an initial bout of volatility and a mid-session decline. Unlike the previous reading which suggested weakness, today witnessed a solid recovery from the intraday lows. The Nifty held firmly above the support zone of 25,160, refusing to succumb to bearish pressure and staying well above the 25,000 psychological mark. The index rebounded significantly from the bottom to settle near 25,290. The market texture has shifted to "Buy on Dips," indicating that bulls are actively defending higher support zones and utilizing corrections to accumulate positions.

Top Gainers (Nifty 50)

These stocks led the charge, delivering the highest returns this day.

Top Losers (Nifty 50)

The following stocks faced selling pressure and registered the day's biggest declines.

F&O Corner

OI Analysis

Near Resistance for the Week: 25,500 The resistance level stands firm at 25,500, which continues to hold the highest Call Open Interest. This visible "Iron Ceiling" suggests that Call writers have built a massive fortress at this level, making it extremely difficult for bulls to breach without significant momentum.

Near Support for the Week: 25,000Significant weakness is visible as the primary support is established at 25,000 (marked as "OI Support"). This strike now holds the highest concentration of Put writing. The solidification of the "Floor" at this psychological level confirms that bears have defined the market's safety net here. A breach of this 25,000 level could trigger aggressive selling.

Put Call Ratio (PCR)

Present Ratio: 0.80 | Current Scenario: BEARISH

The PCR has seen a notable uptick to 0.80 from the previous reading. However, with Total Call OI (15.64 Cr) still outpacing Total Put OI (12.97 Cr), the sentiment remains bearish. The rise in PCR suggests increasing support from Put writers, indicating that while Call writers maintain control, the bearish grip is slightly loosening compared to the prior session.

Max Pain Analysis

The Max Pain strike stands firm at 25,400.00. The data reveals that Max Put Pain (12,155.11 Cr) is marginally higher than Max Call Pain (12,127.97 Cr), indicating a balanced tug-of-war where neither Put nor Call writers are significantly more stressed than the other. This convergence creates a "neutral anchor," suggesting the market may consolidate near 25,400 to minimize losses for option sellers on both sides, reflecting an equilibrium in market sentiment.

Volatility Index (India VIX)

India VIX: 13.35 | ▲ -0.43 (-3.12%)

The Fear Gauge cooled off by 3.12% to settle at 13.35, falling from the previous close of 13.78. This contraction in Implied Volatility (IV) from the prior session suggests that market participants are becoming comfortable writing options, signaling a growing expectation of stability and narrower price swings in the near term.

Major News & Key Events

Here are four important stock market news updates for the day, sourced from Moneycontrol:

- PSU Bank Sector Shines The Nifty PSU Bank index outperformed the broader market by surging over 2%, driven by strong gains in Bank of India and Indian Bank, helping the banking sector snap its three-day losing streak.

- Zee Entertainment Earnings The media major reported a weak quarter with consolidated net profit falling 5.4% to ₹154.8 crore for Q3 FY26, despite expectations of better operational performance.

- Radico Khaitan Results Radico Khaitan posted a strong financial performance for the December quarter, registering a massive 62.25% year-on-year jump in its consolidated net profit.

- Dalmia Bharat Sales Growth Cement manufacturer Dalmia Bharat announced a steady growth in its top line, with consolidated net sales rising by 10.22% year-on-year to ₹3,506 crore for the quarter.

Post Market Analysis – What Today’s Recovery Indicates

This post market analysis highlights a critical trend shift from sell-on-rise to buy-on-dips:

- Bulls defended the 25,160–25,000 support zone

- Strong rebound from intraday lows

- Reduced volatility signals confidence returning

The post stock market structure now shows active accumulation on declines.

Post Stock Market Structure – At a Glance

Final Post Market Outlook

This post market analysis confirms a resilient recovery in the post stock market. Bulls defended key supports, volatility cooled, and intraday structure shifted to accumulation on dips.

Sustaining above 25,000 will remain crucial for continuation of this positive bias.

FAQs

1. What is post market analysis?

Post market analysis is the evaluation of stock market movement after market close, focusing on closing price, intraday trend, derivatives data, volatility, and news to assess the next trading session.

2. How did the Indian stock market close today?

The Indian stock market closed higher today, with Nifty 50 gaining 0.53% after a strong rebound from intraday lows.

3. What does today’s post stock market data suggest?

Today’s post stock market data suggests a shift to a “buy on dips” structure, with strong demand near the 25,000 support zone.

4. Is the post market trend bullish now?

The short-term post market trend has turned mildly bullish due to strong recovery, falling VIX, and active buying at support levels.

5. What are the key levels to watch next session?

Immediate resistance lies near 25,500, while strong support remains at 25,000–25,160.

6. Why did India VIX fall today?

India VIX fell as traders reduced hedging and began writing options, indicating expectations of lower volatility and market stability.

Disclaimer: This report is for informational purposes only and does not constitute financial advice. Please consult your financial advisor before making any investment decisions.

Happy Trading!

The Firstock Team