Post Market Analysis: Nifty Closing, Post Stock Market Review 27-1-2026

Post Market Pulse: The Day in Review

The Indian equity market staged a notable recovery today, snapping a two-session losing streak. The Nifty 50 finished in the green, gaining 126.75 points (+0.51%) to settle at 25,175.40, successfully reclaiming and holding levels above the psychological 25,000 mark. This reversal was primarily driven by positive sentiment surrounding the conclusion of the India-EU Free Trade Agreement negotiations and a late surge in banking and metal stocks.

Index Performance Snapshot

A quick review of the major indices shows the market momentum for the day.

1. Nifty 50

25,175.4 | +126.75 (+0.51%)

Intraday Analysis: The market opened with a volatile start, witnessing an initial dip followed by a steady recovery through the morning. After a period of range-bound consolidation between 11:30 and 13:30, the Nifty demonstrated strong bullish momentum in the final hours. The index surged past intraday resistances to hit a high of approximately 25,230 before a minor cooling off at the close. The "Sell on Rise" sentiment seen in previous sessions has shifted toward a "Buy on Dips" behavior, ending the day on a positive note.

Top Gainers (Nifty 50)

These stocks led the charge, delivering the highest returns this day.

Top Losers (Nifty 50)

The following stocks faced selling pressure and registered the day's biggest declines.

F&O Corner

OI Analysis

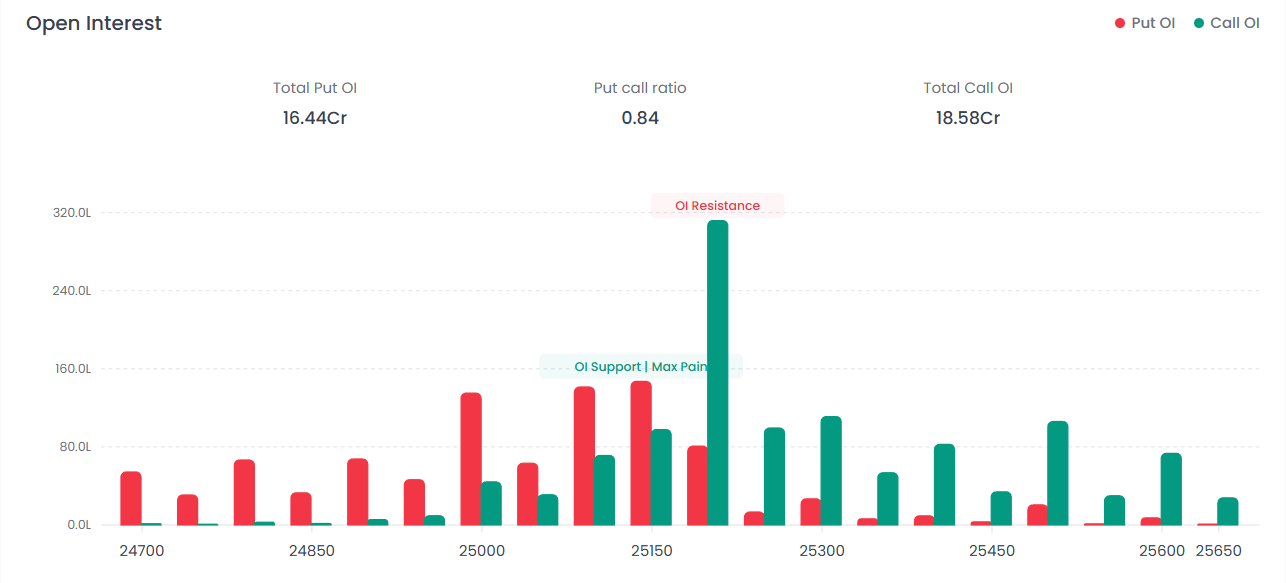

Near Resistance: 25,200 The 25,200 strike has accumulated the highest Call Open Interest (as shown by the prominent green bar), cementing it as the new "Iron Ceiling" for the week. This significant Call writing suggests bears are aggressively defending this level.

Near Support: 25,100 The 25,100 strike currently holds the highest massive Put writing cluster, acting as the primary support or "Floor." As long as this level holds, the market may attempt to consolidate.

PCR Analysis

0.84 | Scenario: BEARISH

The PCR is at 0.84, with Total Call OI (18.58 Cr) outpacing Total Put OI (16.44 Cr). This indicates aggressive Call writing; while the ratio is higher than previous lows, the sentiment remains bearish as long as Call resistance remains heavy.

Max Pain

The Max Pain level is positioned at 25,150, coinciding with the primary support level. This acts as a magnet for the expiration. Any sustained trading away from this level increases pressure on option writers, potentially spiking volatility.

India VIX

Current Level: 14.45 | ▲ +0.26 (+1.83%)

Interpretation: The Fear Gauge settled at 14.45 after a sharp expansion. This indicates that market participants are aggressively buying options, signaling an expectation of increased turbulence and wider price swings in the near term.

Major News

Trade Optimism vs. Tariff Fears: Market sentiment found relief as India and the European Union announced the conclusion of negotiations for a landmark Free Trade Agreement (FTA) today. This countered ongoing global unease regarding US President Donald Trump's new threats to hike reciprocal tariffs on South Korean goods including autos and pharmaceuticals to 25%.

Currency Record Lows: The Indian Rupee (INR) plunged to a fresh record low of 91.99 against the US dollar in early trade. While it showed a marginal recovery toward the 91.50 level supported by DII inflows, it remains vulnerable to sustained FII selling and geopolitical shocks.

Sectoral Performance: Banking and IT stocks acted as the day's pillars. While Bank Nifty initially slipped, it closed as a major outperformer, climbing 1.25%.

Post Market Analysis – What Today’s Recovery Means

This post market analysis reflects a strong trend reversal session driven by:

- Recovery above the 25,000 psychological zone

- Strong late-session buying

- Leadership from banking and metal stocks

The post stock market structure now shows renewed bullish confidence near key supports

Post Stock Market Structure – At a Glance

Final Post Market Outlook

This post market analysis confirms a strong recovery in the post stock market after two weak sessions. Bulls successfully defended the 25,000 zone, while F&O data suggests cautious optimism with volatility still elevated.

Sustaining above 25,000 will remain the key trigger for further upside in the coming days.

FAQs

1. What is post market analysis?

Post market analysis is the evaluation of stock market movement after market close, focusing on closing prices, intraday trend, derivatives data, volatility, and news to predict the next session’s direction.

2. How did the Indian stock market close today?

The Indian stock market closed higher today, with Nifty 50 gaining 0.51% and reclaiming the 25,000 psychological level.

3. What does today’s post stock market data indicate?

Today’s post stock market data indicates a bullish recovery with “buy on dips” behavior and strong late-session momentum.

4. Is the post market trend bullish now?

The short-term post market trend has turned cautiously bullish due to strong recovery, sectoral support, and improved sentiment, though resistance remains overhead.

5. What are the key levels to watch next session?

Immediate resistance is near 25,200–25,250, while strong support lies at 25,100–25,000.

6. Why did India VIX rise today?

India VIX rose as traders aggressively bought options, signaling expectations of higher volatility and wider price swings in coming sessions.

Disclaimer: This report is for informational purposes only and does not constitute financial advice. Please consult your financial advisor before making any investment decisions. Happy Trading! The Firstock Team