Post Market Analysis: Nifty Closing, Post Stock Market Review 3-2-2026

Post Market Pulse: The Day in Review 📊

The Indian equity market staged a spectacular recovery today, fueled by optimism following a landmark India-US trade agreement. Despite a massive gap-up opening that saw the Nifty 50 touch a session high of 26,341, the index faced intense profit-booking in the first half. However, the market displayed remarkable resilience, finding strong support at lower levels to close with a solid gain of over 2.5%, marking one of its best single-day performances in recent months.

Index Performance Snapshot

Nifty 50

25,727.55 | +639.15 (+2.55%)

Intraday Analysis: The index opened with a massive gap-up of over 1,200 points at 26,308, driven by the trade deal euphoria. However, initial exuberance was met with sharp selling pressure, dragging the index down to a low of 25,641 by mid-morning. The tide turned around 11:30 AM as institutional buying emerged at support levels. The Nifty stabilized and recovered steadily, reclaiming the 25,700 mark to close near the upper end of its post-correction range.

Top Gainers (Nifty 50)

Power, Auto, and Infrastructure stocks led the recovery charge.

Top Losers (Nifty 50)

Financials and IT stocks exerted pressure on the index.

F&O Corner

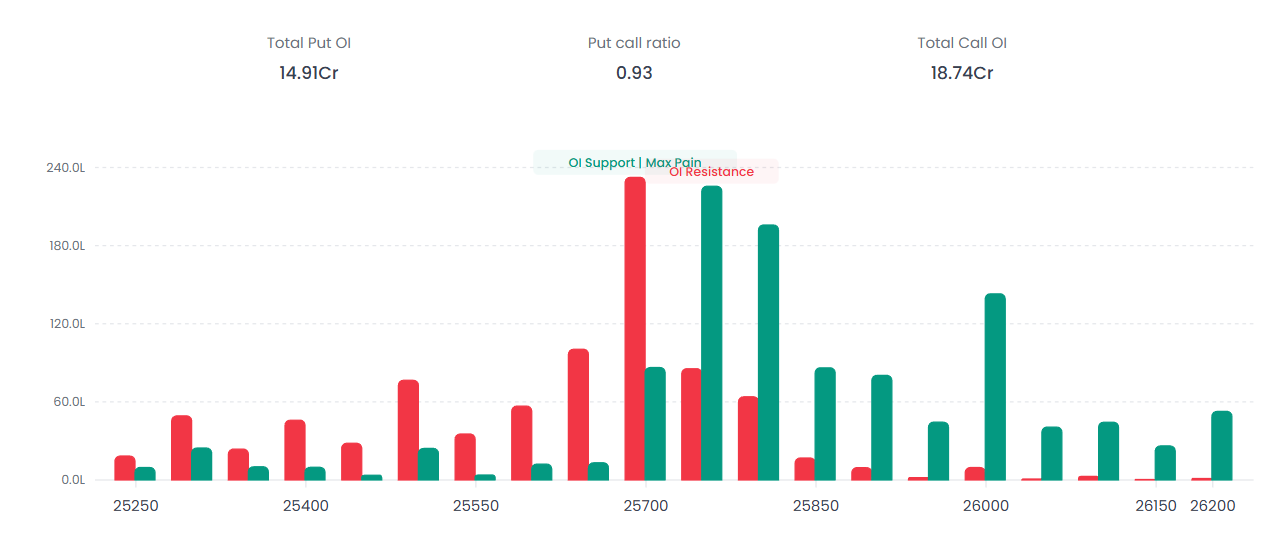

OI Analysis

Near Resistance: 25,750 The 25,750 strike holds a high Call Open Interest (Green bar), acting as the immediate "Iron Ceiling" for the market.

Near Support: 25,700 Significant Put Open Interest is visible at 25,700, providing a base. This level is currently the battleground, aligning with the Max Pain.

PCR Analysis

0.93

The Put Call Ratio (PCR) stands at 0.93, indicating a balanced market sentiment. It reflects that neither bulls nor bears have a decisive upper hand at closing, suggesting consolidation or a potential breakout if the ratio improves.

Max Pain

The Max Pain Strike is positioned at 25,700.00. This implies that the market expiration is gravitating towards this level to inflict maximum pain on option buyers.

India VIX

Current Level: 12.89 | ▼ -0.97 (-7%)

Interpretation: The Fear Gauge has cooled off significantly, dropping nearly 7% to settle at 12.90. This sharp contraction suggests that the high-stakes uncertainty surrounding trade policies and the budget has largely dissipated. A VIX level below 13 indicates a return of investor confidence and a transition into a more stable, "low-fear" environment for the market.

Major Market Drivers

Adani Group Momentum: A massive surge in Adani Enterprises (+10.38%) and Adani Ports (+9.12%) provided the heavy lifting for the index today, following strong quarterly results and positive sentiment around US trade deals.

Sectoral Divergence: While the Infrastructure and Finance sectors saw robust buying interest (Jio Financial +8.11%, Bajaj Finance +6.68%), the IT sector faced minor headwinds with Tech Mahindra leading the losers, keeping the overall index gains from reaching record highs.

India-US Trade Deal: The announcement of a trade agreement reducing reciprocal tariffs on Indian goods was the primary catalyst, sparking broad-based buying across export-oriented and large-cap sectors.

Daily Market Review – What Indian Stock Market Today Signals

This daily market review highlights a powerful bullish recovery driven by:

- Strong institutional buying at support

- Positive India-US trade deal sentiment

- Broad-based participation in infrastructure & financial stocks

The post market review suggests that momentum has shifted decisively in favor of bulls after a strong 2.55% surge.

Indian Stock Market Today – Structure Summary

Final Post Market Review Outlook

This daily market review confirms that the Indian stock market today witnessed one of its strongest sessions in recent months. A powerful recovery from intraday lows, combined with easing volatility, indicates improving sentiment.

Sustaining above 25,700 will be crucial for continuation of bullish momentum in upcoming sessions.

FAQs

1. What happened in the Indian stock market today?

The Indian stock market today surged 2.55%, driven by optimism around the India-US trade deal and strong institutional buying.

2. What is a daily market review?

A daily market review analyzes stock market performance after closing, including price action, sector movement, derivatives data, and volatility trends.

3. Why did Nifty rise today?

Nifty rose due to strong buying in Adani Group stocks, financials, and infrastructure sectors following positive trade deal developments.

4. What does PCR of 0.93 indicate?

A PCR of 0.93 indicates balanced sentiment between bulls and bears, suggesting consolidation unless momentum expands.

5. Is the Indian stock market today bullish?

Yes, the short-term trend appears bullish after a strong recovery and falling India VIX, signaling improved investor confidence.

Disclaimer: This report is for informational purposes only and does not constitute financial advice. Please consult your financial advisor before making any investment decisions.

Happy Trading!

The Firstock Team